Our CEO Jessica I. Marschall, CPA, ISA AM recently attended the Appraisers Association of America annual conference in Manhattan.

IRS Counsel and presenters included Karin Gross, Meredith Meuwly, and Cynthia Herbert and provided critical feedback on the appraisal process.

-

1.

Appraisers: Stay in Your Lane!

Appraisers were warned not to provide tax advice to clients. Taxpayers must retain a tax advisor. Should a client go to Tax Court, their reliance upon advice given by an appraiser does not suffice.

Appraisers were reminded that they only sign and fill out their section of Form 8283 on page 2. Most of the form must be completed by the taxpayer and/or their advisor. The nonprofit only signs their portion on page two. Appraisers do not fill out any other section of Form 8283.

-

2.

Digital Signatures

Digital signatures on Form 8283 are here to stay so digitally sign away!

-

3.

Similar Types of Property Defined

The IRS has a grouping requirement where any group of property exceeding an aggregate value of $5,000 requires an appraisal. If a donor donates three sets of books in January, March, and September with values of $2,000 each, the aggregate value is $6,000 and would require an appraisal for ALL books donated.

Similar items of property are defined as followed and the tax code reference is 26 CFR 1.70A-13 (c)(7)(iii)

-

a.

Stamp collections

-

b.

Coin collections

-

c.

Lithographs

-

d.

Paintings

-

e.

Photographs

-

f.

Books

-

g.

Non publicly traded stock

-

h.

Land

-

i.

Buildings

-

j.

Clothing

-

k.

Jewelry

-

l.

Furniture

-

m.

Sculpture

-

n.

Ceramics

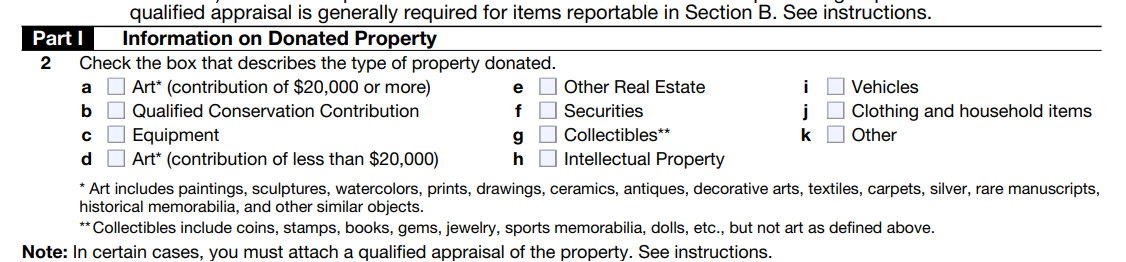

Additional guidance included that anytime a work is in a separate medium, be conservative and put it in its own category. Please note that the above-listed items do not match with the current boxes on page 1 Section B Part 1:

-

-

4.

Purchase Low Donate High?

The IRS warned taxpayers to watch for promotions involving exaggerated art donation deductions by buying low, holding for one-year to accomplish the long-term capital gain holding period and then donating high. If it is too good to be true then it probably is. Some taxpayers are forming partnerships to acquire property at very low prices and then donate at higher Fair Market Value. The law is evolving based upon the principles under conservation easements and running concurrently with the law decisions. This guidance does not apply only to art but to any personal property purchased for a low price and donated at significantly higher Fair Market Value.

-

5.

How Many 8283s?

It may be many. There will be separate 8283s for each recipient charity and/or each dated donation throughout the year.

-

6.

Appraiser’s EIN or SSN

Each signatory to an appraisal must provide their EIN if they own the appraisal company or must provide their SSN if they are an employee of the appraisal company. Yes, this means that hundreds of people may have the SSN of the appraiser if they are not the company owner. This can be avoided by each appraiser applying for an EIN online through IRS.gov for no charge as a sole proprietor or becoming an LLC or other pass-through entity.

-

7.

New Form 8283 in December…?

A new Form 8283 will probably go live in December 2023. IRS Counsel suggested it may be best practice to redo all 8283s for tax year 2023 to conform with the new form. Our firm will be taking this step, which will require new signatures from nonprofits and the redoing of the form by the taxpayer’s tax preparer.

The new form will include a box for Certified Historic Structures with a blank line for the NPS# as well as a new box for digital assets.

-

8.

What About Donating to a “Friends Of” Organization.

What about the contribution of a “Friends Of” contribution that supports a foreign charity organized and operated in the US but supports a foreign museum? If you give cash to the Friends Of it is generally ok or has fundraisers for it, that is ok. However, if you give non-cash donations to a Friends Of and then give it to a foreign museum, that will ship it right out to the foreign museum, that is not ok and not deductible.

-

a.

Unrelated use—if you give property to charity for an unrelated use it cannot exceed the taxpayer’s basis. If you give art to a museum that is related use, and the taxpayer has a long-term capital gain property then deduction equal to FMV. If art goes to the Boy Scouts they might have a legitimate reason for art but it is probably an unrelated use.

-

b.

Friends Of presents a conduit problem; art being donated is not actually being used by the Friends Of organization.

-

-

9.

Technical Suggestions and Requirements

Appraisals must include:

-

a.

Number of items in the appraisal

-

b.

Number of pages of the report and total number at the bottom

-

c.

Sign the report

-

d.

Create a spreadsheet if more than a few items

-

e.

Good quality of images of subject properties

-

f.

Put a total cumulative sum of the value of the items in your report

-

g.

Ensure the correct Fair Market Value citation is listed in the report when appraising for charitable, gift, or estate tax purposes.

Formatting:

-

a.

Correct dates: effective, valuation, and report date

-

b.

Correct value types and correct client names

-

c.

Make sure the glossary includes terms that are relevant to your assignment and avoid superfluous terms

-

d.

Do not include unrelated extensive quotes

-

e.

Do not include unrelated market narrative

Describing the subject property:

-

a.

Name of artist, maker

-

b.

Title

-

c.

Date

-

d.

Medium and support (oil on canvas, oil on board, watercolor on paper, cast dates, boundary markings, photographs both the negative and the print date.)

-

e.

Size (cite actual dimensions or weight if applicable, for objects made from silver, gold, or other precious materials).

-

f.

Signatures: marks, distinguishing features, symbols, or labels on the back or front of the object.

Additional information:

-

a.

Sales agreements (private or auction sale documentation, proceeds statements)

-

b.

Acquisition information (it is imperative to know the cost, date, and source)

-

c.

Additional provenance

-

d.

Any reference source citing the items including standard publications (catalogue raisonne news article, or in a museum exhibition catalogue)

-

e.

Record of exhibition in which the work of art was displayed. Need to know if this work of art was in the exhibition. Tailor down the exhibition to what is relevant.

Photograph:

-

a.

Digital/electronic images whenever possible, send high quality Jpegs

-

b.

It is the taxpayer’s responsibility to provide good quality images

-

c.

Poor quality photographs impede timely review/audit

-

d.

Panel members may refuse to opine, therefore putting the review off until the next Panel meeting.

-

e.

Get straight eyed shots

-

f.

Glazed items are tough to photograph but do our best. Pretend we are the IRS in order to determine the value.

-

g.

#1 complaint of the IRS Art Advisory Services are bad photographs

Condition reports:

-

a.

One word description of condition does not suffice

-

b.

O’Connor v Commissioner 2001 a description of the physical condition of property generally described as merely new, used, good, fair, dismantled, or discard is inadequate because without a more detailed description of the appraiser’s approach and methodology cannot be evaluated.

-

c.

When you know that condition is a significant factor of value you might need to get a professional condition report. USPAP gives us the responsibility and flexibility to decide what we need to do.

Research:

-

a.

Consult CRs or recognized authorities on artists whenever possible

-

b.

Appraisers are not authenticators but do your due diligence

-

c.

Do not rely on a single database for comparable sales

-

d.

Avoid “Laundry List” line-item appraisals with no support or narrative

-

e.

Avoid laundry list comparable sales

-

f.

Stay in your lane—if you do not have the required competency, get help or decline.

Comparable Sales:

-

a.

If you cite comparable sales without providing narrative then you have not determined value.

-

b.

Do not include comparable sales without photos or explanation.

-

c.

Place the subject property within the marketplace and the artist’s oeuvres

-

d.

Provide rationale

-

e.

Do not just cite comparable sales and let the comparable sales speak for themselves

-

f.

If you are going to consider asking prices you need support with additional information. Example Chairish 1st Dibs

-

g.

If you list a comparable sale then talk about it

-

-

10.

Form 8282

When filed, form 8282 will not only identify unrelated use but it will also give the IRS an indication of value. The deed of gift cannot put a condition on the transferability of the gift. How does Form 8283 affect value? It complicates the taxpayer’s job and can reduce the value.

-

11.

Date of Acquisition

The taxpayer must include the date of acquisition. If it is not an exact date or is unknown, the IRS gave the advice to explain, explain, explain. Do not leave this information blank.