Form 8283 is indeed a crucial form when it comes to charitable contributions made by individuals and corporations in the United States. It is used to report non-cash charitable contributions, such as property or assets, and it plays a significant role in substantiating the value of these contributions for tax deduction purposes.

Form 8283 is one of the few forms connected to the 1040 and 1120 that brings in the attestation of two independent parties to an entity’s return: the appraiser and nonprofit. IRS Counsel Karin Gross and Theresa Melchoire have repeatedly emphasized the role of both the appraiser and nonprofit in their designed areas for completion as well as the portions of the form that they should NOT complete. At the annual American Society of Appraisers conference in October 2023, the importance of which party fills out which portion was emphasized once again

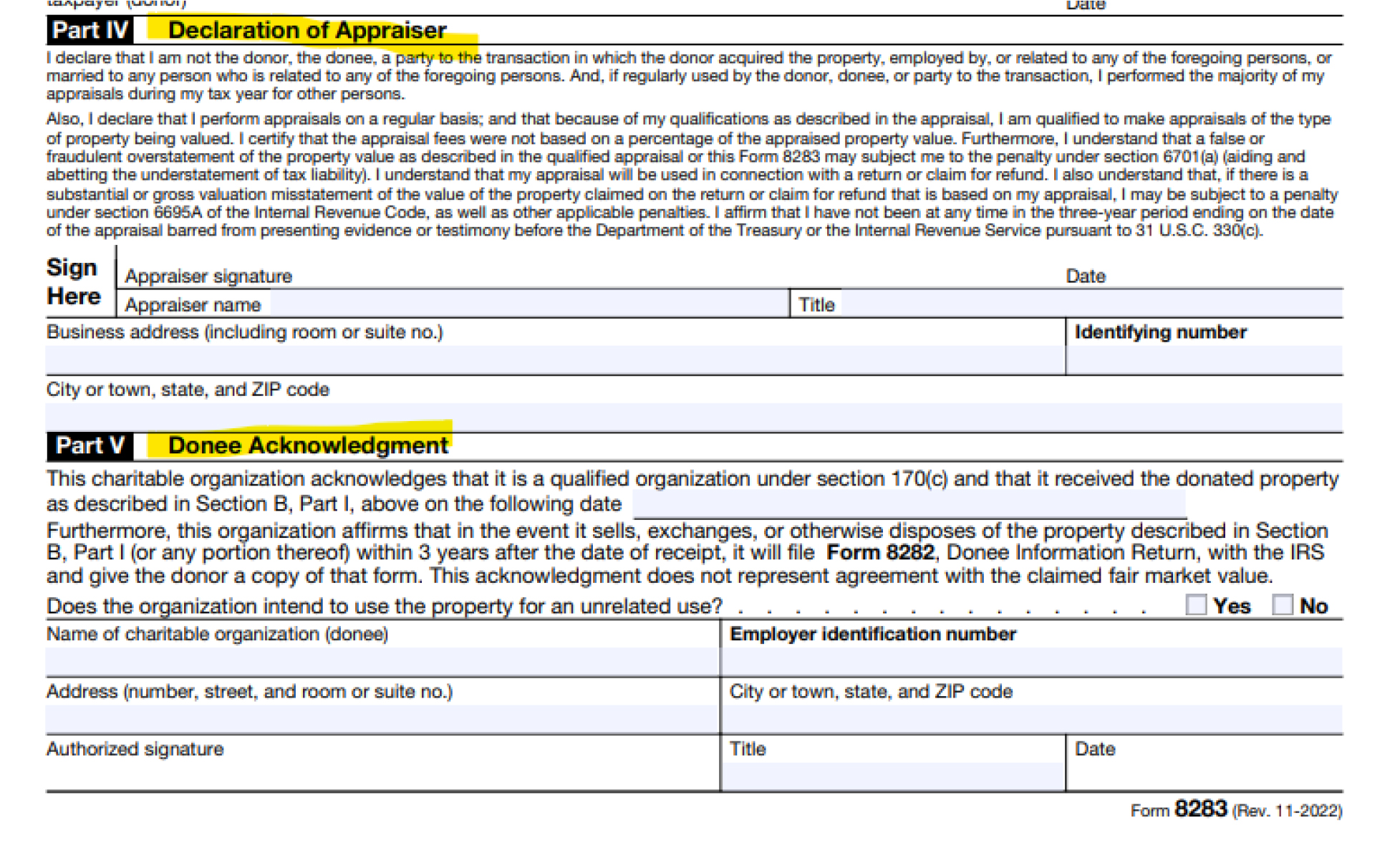

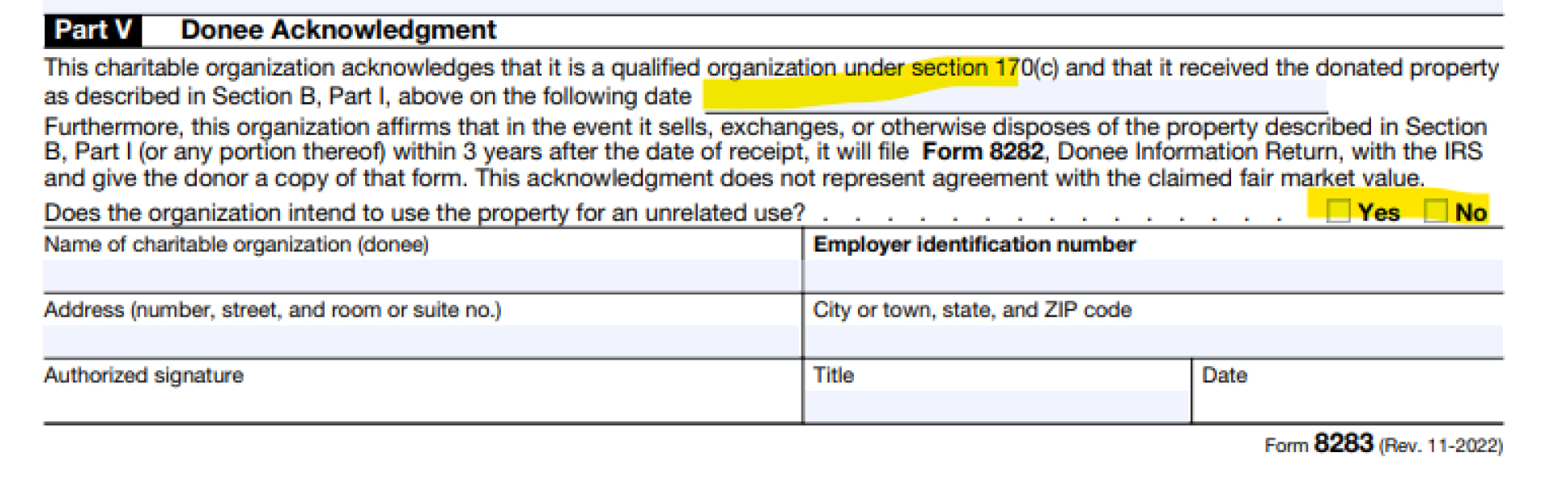

Appraisers and nonprofits are relegated to Part IV Declaration of Appraiser by the appraiser and Part V Donee Acknowledgement to be completed by the nonprofit.

Filling out other sections of the form by either the appraiser or the nonprofit adds unnecessary significant risks and liability to the appraiser or the nonprofit. The other sections should ONLY be completed by the taxpayer and their CPA.

We have noticed that some nonprofits are not filling out the top portion of Part V Donee Acknowledgemen:t

Form 8283 falls under strict compliance under §155 of the Deficit Reduction Act of 1984 (DEFRA) and missing a single entry on the form is grounds for disallowance of the deduction. (See Loube v. Commissioner 2020).

The first highlighted area documents the date of donation.

The second boxes alert the IRS whether the nonprofit intends to use the property for an unrelated use. Checking one of the boxes is critical.

If a nonprofit does not plan on using the donation for a “Related Use” aligning with their nonprofit mission as documented in the 1023 501(c)(3) application, the donation could be disallowed due to the lack of related use to the nonprofit.

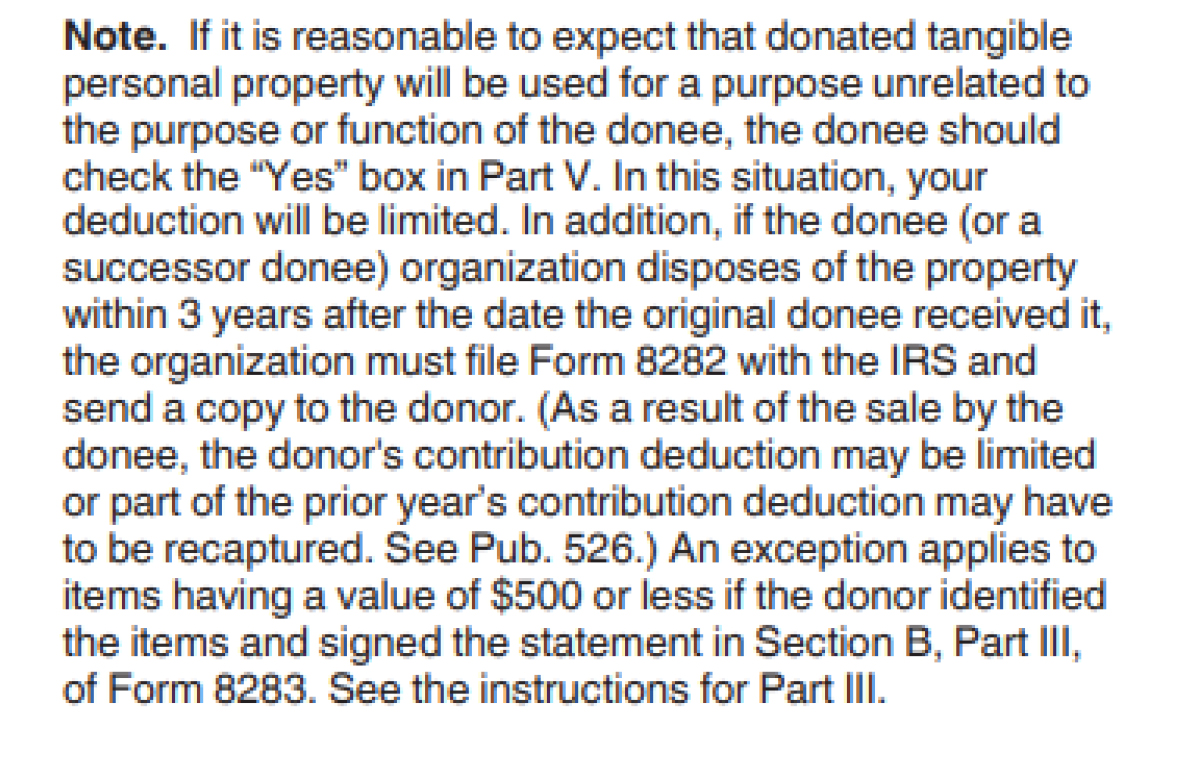

Additionally, if the nonprofit does not affirm that the donation is NOT for an unrelated use, the future sale of the property, as documented on Forms 8282 within three years of the donation triggers a claw-back of the delta between the appraised Fair Market Value and the nonprofit’s sales price.

For example, if a nonprofit receives a Viking range that has a FMV of $6,000 and sells it in a liquidation sale for $500, if they do not have a related use of selling property to the general public, the taxpayer would retroactively have their donation reduced by $5,500.

There are two exceptions to the 8282 claw-back value rule:

-

1.

If the item had an appraised value of less than $500

-

1.

If the items were used to fulfill the exempt purpose of the tax exempt organization.

If the nonprofit does not fill out the top portion of Part V, include the date and check YES or NO the IRS cannot determine if the subsequent sale of the property was part of the related use of the organization.

From the instructions:

Nonprofits and taxpayers must consult with their own CPAs for guidance on completion of Form 8283. The guidance provided within this document is only for general informational purposes and not as specific tax advice.