Historic preservation and deconstruction go hand-in-hand. Our CEO Jessica I. Marschall, CPA, ISA AM, recently joined the Minnesota-based Rethos Board of Directors. With her background in tax and deconstruction tax deductions, she hopes to assist in educating others about the distinctions between historic preservation versus deconstruction and encouraging the responsible and thoughtful approach to handling historic structures and materials.

Read on to hear more:

Who is Rethos?

Why Preserve Historic Property or Any Property?

What are the Specific Historic Tax Credits?

What is the Timeline for Historic Preservation and Deconstruction?

Promoting a holistic approach that considers both preservation and sustainability is essential for the long-term well-being of historic communities and their built heritage.

It is important to emphasize the importance of historic preservation before considering deconstruction. It is crucial to prioritize the preservation of historic structures whenever possible to maintain their cultural and architectural significance.

Deconstruction, which involves the careful disassembly of a structure with the goal of salvaging and reusing materials, is an environmentally sustainable practice that can also contribute to reducing construction waste. While it may provide certain tax benefits through deductions for the value of salvaged materials, it should not come at the expense of neglecting the potential for historic preservation and the associated tax credits or incentives that can support such efforts.

Section One: Who is Rethos?

From Rethos:

We are Rethos, a 501(c)(3) nonprofit organization working nationwide for the use of old buildings and sites.

We are holistic in our thoughts and flexible in our approach. We activate space, invest in communities, and reimagine what can be.

We celebrate the fundamental character of a community and the qualities that define those communities.

Our Mission

To lead and inspire people to connect with historic places, promoting community vitality.

Our Vission

We believe that old buildings, culture, and small businesses are the foundation for communities to flourish.

Our Purpose

At Rethos, our purpose to reimagine places comes to life through core services that help educate, motivate and strengthen communities. Our board, staff, and partners work together to protect and promote communities’ shared environment and culture.

Section Two: Why Preserve Historic Property or Any Property?

Preserving historical properties rather than demolishing them offers numerous benefits, both culturally and economically. Here are some compelling reasons why people should consider leaving historical properties intact:

One—Cultural and Historical Significance:Historical properties often have cultural and historical significance that contributes to the identity and heritage of a community. They may represent a particular architectural style, period, or events from the past. Preserving these properties helps maintain a connection to history and enriches our understanding of the past.

Two—Community Identity and Sense of Place:Historical properties are integral to a community's sense of identity and place. They can be landmarks that residents and visitors identify with, fostering a sense of pride and belonging.

Three—Tourism and Economic Benefits:Historical properties can attract tourists and visitors, boosting local economies through increased tourism-related spending. Preserved historic districts and properties can become popular destinations for heritage tourism.

Four—Environmental Sustainability:Retrofitting and preserving historical buildings can be more environmentally sustainable than demolishing them and constructing new structures. It can reduce the carbon footprint associated with manufacturing new building materials and contribute to energy conservation.

Five—Unique Architectural Features:Historical properties often possess unique and intricate architectural features that are not commonly found in modern construction. These features can add character and charm to a neighborhood or city.

Six—Property Value:Historical properties that are well-maintained and preserved often retain or increase in value over time. They can enhance property values in their vicinity.

Seven—Tax Incentives:Various tax incentives, such as federal and state historic tax credits, are available to property owners who rehabilitate and preserve historical buildings. These incentives can significantly offset the costs of restoration and rehabilitation. We outline these below.

Eight—Educational and Research Opportunities:Historical properties offer opportunities for education and research. They can serve as living museums, providing insights into different eras, building techniques, and architectural styles.

Nine—Social and Community Benefits:Preservation projects often involve community engagement and collaboration, fostering a sense of unity and civic pride. They can bring people together to work toward a common goal.

Ten—Legal Protections:Many historical properties are protected by local, state, or federal preservation laws and regulations. Demolishing such properties may require approvals and permits, making preservation the more practical and legal option.

Eleven—Long-Term Cost Savings:In some cases, the cost of preserving a historical property may be comparable to or even lower than demolishing it and building a new structure, especially when considering the potential tax incentives and grants available for preservation efforts.

Preserving historical properties is not only a responsible way to honor our shared history but also offers a range of economic, cultural, and environmental benefits. It can enhance the quality of life in communities and contribute to their sustainable development.

Section Three: What are the Specific Historic Tax Credits?

Historic tax credits are financial incentives provided by the government to encourage the preservation and rehabilitation of historic buildings and structures. These credits are typically offered at the federal and, in some cases, state or local levels in the United States. The details of historic tax credits can vary, but here are some key aspects:

Types of Historic Tax Credits:

Federal Historic Tax Credit (HTC): Administered by the National Park Service (NPS) and the Internal Revenue Service (IRS), this credit provides a financial incentive for the rehabilitation of income-producing historic buildings. As of my last knowledge update in September 2021, the federal HTC offers a tax credit equal to 20% of qualified rehabilitation expenses for income-producing properties listed on the National Register of Historic Places.

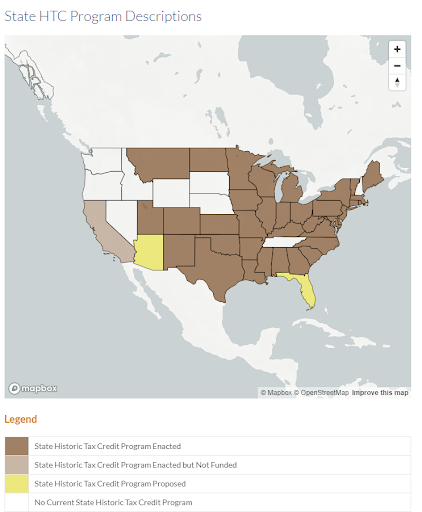

State Historic Tax Credits:

Some states offer their own historic tax credits in addition to the federal credit. These credits may have different percentages, eligibility criteria, and application processes. The availability and details of state credits can vary widely.

Eligibility:

To qualify for historic tax credits, a property must typically be listed on the National Register of Historic Places or be eligible for listing. The property must also be used for income-producing purposes.

Qualified Rehabilitation Expenses (QREs):

The tax credit is based on the "qualified rehabilitation expenses" incurred during the rehabilitation of the historic property. These expenses may include costs related to the restoration, renovation, and repair of the historic elements of the building.

Compliance with Preservation Standards:

Property owners must adhere to the Secretary of the Interior's Standards for Rehabilitation, which outline the guidelines for preserving the historic character of the building during the rehabilitation process.

Application and Certification:

Property owners must apply for historic tax credits and receive certification from the appropriate government agencies (NPS for federal credits). The certification process involves documenting the rehabilitation work and demonstrating compliance with program requirements.

Credit Transferability:

In some cases, property owners may sell their historic tax credits to investors who can use them to offset their own tax liabilities. This allows developers to attract investment for historic rehabilitation projects.

Limitations and Restrictions:

There may be limitations on the amount of tax credits that can be claimed in a single year, and unused credits can often be carried forward. Additionally, the tax credits are subject to recapture if the property is not maintained according to preservation standards for a certain period after rehabilitation.

Economic Impact:

Historic tax credits are designed to promote economic development and revitalization in historic areas by incentivizing the preservation and adaptive reuse of historic structures.

Thirty-eight states offer Historic Tax Credits

1

“The National Trust for Historic Preservation has long supported the enactment of state historic tax credits (HTC) because the reuse of historic buildings is an essential strategy to create more inclusive, prosperous, and resilient communities. As a redevelopment tool, these credits attract private investment and transform underutilized historic buildings into economically-productive community assets once again.”

—Renee Kuhlman, co-author of State Historic Tax Credits: Maximizing Preservation, Community Revitalization, and Economic Impact.2

From Novogradac, the following states are divided into enacted, enacted but not funded, proposed and no credit through the map below:

3

Their website offers details into each specific state’s credit:

Section Four: What is the Timeline for Historic Preservation and Deconstruction?

-

1.Initial assessment:

-

a.Determine what can remain in place, especially the “bones” of the building. Is there deterioration, structural damage, or safety hazards?

-

b.What still has use but will be extracted as part of the renovation.

-

c.Can it be donated to charity or another governmental organization for a tax deduction? Jump to #10 below and consider bringing in the deconstruction contractor and IRS Qualified Appraiser at this point.

-

-

2.Historical significance:

-

a.Determine the historical and architectural significance of the building. This may involve researching its history, architectural style, and any past use.

-

b.Consult with local historical preservation organizations, if available, for guidance on the building's historical importance.

-

-

3.Structural Assessment:

-

a.Evaluate the structural integrity of the building.

-

b.Consider hiring a structural engineer to assess the foundation, walls, roof, and overall structural stability.

-

-

4.Building Codes and Regulations:

-

a.Research local building codes and zoning regulations to understand what is allowed in terms of renovation and adaptive reuse.

-

b.Determine if the building is listed on a historic register or protected by local preservation ordinances, as these may have specific requirements for rehabilitation.

-

b.Determine what can be safely extracted through deconstruction and donated for reuse.

-

-

5.Feasibility Study:

-

a.Conduct a feasibility study to assess the economic viability of rehabilitation. This should include cost estimates for repairs and renovations, as well as potential income from the new use.

-

-

6.Deconstruction Tax Deduction:

-

a.Determine if a tax deduction for deconstruction is available. Conference with an IRS Qualified Appraisal to determine an initial potential value range. Gather fees for the appraisal, consult with your CPA or tax professional, and determine the financial benefits of donation.

-

b.Please refer to our other articles for details on the tax deduction.

-

-

7.Environmental and Site Considerations:

-

a.Evaluate the environmental impact of the rehabilitation project, including any potential contamination issues.

-

b.Consider the building's location, accessibility, and suitability for the intended reuse.

-

-

8.Architectural and Design Considerations:

-

a.Develop a design plan that respects the building's historical features while accommodating modern needs.

-

b.Ensure that the proposed design complies with building codes and accessibility requirements.

-

-

9.Community and Stakeholder Engagement:

-

a.Engage with the local community and stakeholders to gather input and support for the rehabilitation project.

-

b.If not donating to charity, determine if extracted elements can be reused by other community members or organizations.

-

-

10.Financial Resources:

-

a.Identify potential funding sources, such as grants, tax incentives, or historic preservation funds, to help finance the rehabilitation.

-

b.As listed in 5b, determine the benefit of the tax deduction based upon individual, pass-through, or corporate taxation considerations.

-

-

11.Deconstructed Materials:

-

a.Determine what materials will be extracted during renovation and if there is the potential for reuse.

-

b.Check in with a deconstruction contractor for assistance in making this determination.

-

c.Conference with a deconstruction appraiser to determine the potential value if a tax deduction is available.

-

-

12.Project Timeline:

-

a.Create a realistic project timeline that outlines key milestones and deadlines for completion.

-

-

13.Legal and Permitting Process:

-

a.Obtain the necessary permits and approvals from local authorities and preservation agencies.

-

-

14.Construction and Rehabilitation:

-

a.Execute the rehabilitation according to the approved plans, ensuring that historical elements are preserved or restored as needed.

-

b.Ensure a deconstruction contractor extracts materials to be donated and are safely delivered to the recipient charity or governmental organization (if a tax deduction is being used) or to other for-profit recipients (if a tax deduction is not being used).

-

-

15.Ongoing Maintenance and Monitoring:

-

a.Establish a plan for ongoing maintenance to ensure the building's long-term sustainability and preservation.

-

-

16.Adaptive Reuse Plan:

-

a.Define the specific new use of the building, whether it's residential, commercial, cultural, or another purpose.

-

-

17.Documentation and Record Keeping:

-

a.Maintain detailed records of the rehabilitation process, including photographs, architectural drawings, and any historic documentation.

-

-

18.Final Assessment:

-

a.After completion, assess the success of the rehabilitation project in terms of meeting historical preservation goals, economic viability, and community impact.

-

Conclusion: Preserve First, Donate Second, Dump Last!

Preserve historic property, if possible.

Deconstruct and donate what must be removed.

Recycle.

Only head to the landfill with the bare minimum.

1 https://heritage-consulting.com/state-htc/

2 https://heritage-consulting.com/state-htc/

Here is a link to the Minnesota Historic Rehabilitation Tax Credit, with which Rethos has helped implement:

https://extension.umn.edu/source-magazine/historic-rehabilitation-tax-credit-study-informs-decisions

https://extension.umn.edu/community-research/minnesota-historic-rehabilitation-tax-credit